Summary:

Travel insurance is a valuable tool for mitigating risks associated with travel, offering protection against unexpected medical emergencies, cancellations, and lost luggage. However, it is not a one-size-fits-all solution, and the benefits must be weighed against the costs, exclusions, and specific coverage needs of the traveler. When choosing a travel insurance policy, consider factors such as the type of coverage, trip duration, destination, and any planned high-risk activities. Travelers should also be wary of ambiguous policy terms and high-pressure sales tactics.

Travel Insurance: Pros, Cons, and What to Consider Before Buying

Travel insurance is an essential consideration for many travelers, offering financial protection in case of unforeseen events such as medical emergencies, trip cancellations, or lost belongings. Although it can provide peace of mind, not every insurance policy is suitable for every traveler. Understanding the benefits, drawbacks, and key factors to consider can help you make an informed decision.

What is Travel Insurance?

Travel insurance is a coverage policy designed to protect you financially from losses associated with traveling. Policies typically cover various scenarios like trip cancellations, delays, medical expenses, lost luggage, and even accidental death. Different types of travel insurance plans offer different levels of coverage, and travelers can opt for single-trip or annual multi-trip policies depending on their needs.

Pros of Travel Insurance

- Emergency Medical Coverage

- One of the most significant advantages of travel insurance is its medical coverage, especially for international travel. Medical emergencies abroad can be expensive, and travel insurance often covers the cost of treatments, hospital stays, and even medical evacuations.

- Trip Cancellation and Interruption Protection

- Travel insurance can reimburse you for prepaid, non-refundable expenses if you need to cancel your trip due to covered reasons such as illness, family emergencies, or natural disasters.

- Lost or Delayed Luggage Compensation

- If your luggage is lost, damaged, or delayed, travel insurance can help compensate for replacement items, allowing you to continue your trip without significant inconvenience.

- Travel Delay Coverage

- Travel insurance can cover additional expenses incurred due to travel delays, such as meals, accommodation, or transportation.

- Peace of Mind

- Travel insurance provides a safety net that allows you to travel with less worry, knowing that unforeseen events will not leave you financially vulnerable.

Cons of Travel Insurance

- Cost

- Depending on the coverage, travel insurance can be expensive, especially for longer trips or older travelers. Some travelers may find the cost outweighs the potential benefits.

- Exclusions and Limitations

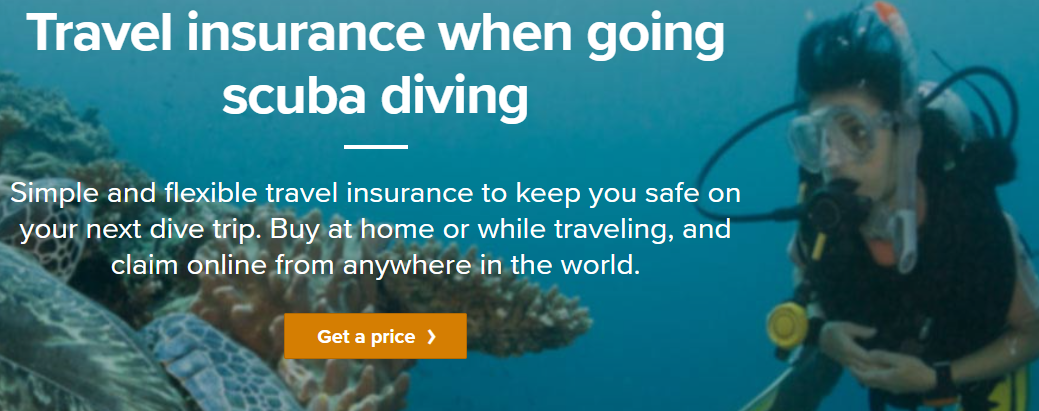

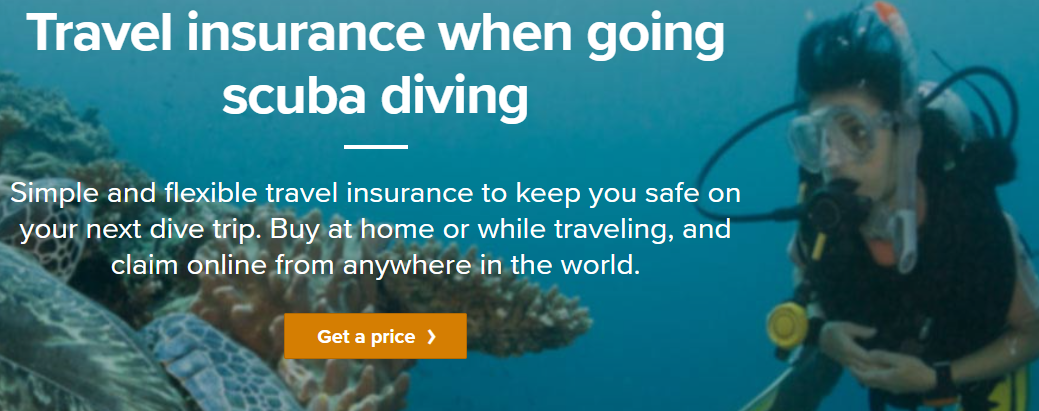

- Not all travel-related risks are covered by standard policies. For instance, adventure activities like skydiving or scuba diving may not be included. Additionally, some policies have limitations on pre-existing medical conditions.

- Claim Denials

- There are situations where claims may be denied due to not meeting the specified conditions in the policy. For example, cancellations due to non-medical reasons may not qualify for coverage.

- Redundant Coverage

- Some travelers may already have existing coverage through credit cards or health insurance, making additional travel insurance redundant. It’s essential to review existing policies before purchasing separate travel insurance.

- Complex Terms and Conditions

- Travel insurance policies can be difficult to understand, with intricate terms and conditions. It’s easy to overlook details that could result in denied claims.

What to Consider When Buying Travel Insurance

- Type of Coverage

- Determine what type of coverage you need. Are you looking for comprehensive coverage (medical, trip cancellation, baggage) or just medical insurance? Make sure the policy covers the specific activities you plan to engage in, such as skiing or scuba diving.

- Destination-Specific Coverage

- The coverage requirements may differ depending on the destination. Some countries, for instance, have mandatory travel insurance requirements for tourists. Additionally, consider the healthcare quality in the destination country; traveling to a place with expensive medical services might warrant more comprehensive coverage.

- Pre-Existing Medical Conditions

- If you have a pre-existing medical condition, look for a policy that offers coverage for these conditions. Some insurers offer “pre-existing condition waivers,” but typically, certain conditions may be excluded.

- Trip Duration and Frequency

- For frequent travelers, an annual multi-trip policy could be more economical than purchasing insurance for each individual trip. Conversely, if you’re only taking a single vacation, a one-time policy might suffice.

- Adventure Activities and High-Risk Sports

- If you plan to participate in activities like skiing, scuba diving, or mountain climbing, ensure the policy covers these activities. Adventure sports may be considered high-risk, and many standard policies will not provide coverage for injuries sustained during such activities.

- Policy Exclusions

- Review the exclusions and limitations of the policy carefully. Know what isn’t covered, so you can avoid situations that would make claims ineligible.

- Cancellation Policy

- Not all cancellation reasons are covered under standard policies. If you want coverage for cancellations due to non-medical reasons (e.g., changing your mind or work commitments), look for a “Cancel For Any Reason” (CFAR) add-on.

- Claim Process

- Look for travel insurance providers with a straightforward claim process and good customer reviews. A cumbersome claim process can be frustrating, especially when dealing with stressful situations abroad.

- Travel Insurance Through Credit Cards

- Some credit card companies offer travel insurance as a benefit. It’s worth checking if your credit card already provides adequate coverage, which could save you from purchasing a separate policy.

- Emergency Assistance Services

- Make sure the insurance provider offers 24/7 emergency assistance services. This service can be valuable when you need help coordinating care during a medical emergency or arranging a medical evacuation.

Controversial Aspects of Travel Insurance

- Travel Insurance Isn’t Always Necessary

- Some argue that travel insurance is often an unnecessary expense, particularly for domestic trips or countries with low-cost medical services. In some cases, self-insurance (setting aside emergency funds) could be a better alternative.

- Ambiguity in Coverage Terms

- Travel insurance policies often contain ambiguous language, making it difficult for travelers to understand exactly what is covered and what isn’t. This can result in unexpected claim denials.

- Disparity Between Cost and Benefits

- Some travelers feel the cost of travel insurance is too high relative to the likelihood of needing to use it. For trips to destinations with affordable medical services, insurance may not be cost-effective.

- Pressure Tactics

- Some travel agencies and insurance companies use high-pressure sales tactics to convince travelers to purchase policies without thoroughly explaining the limitations and exclusions.

- Pre-Existing Conditions and Age Discrimination

- Travel insurance policies often discriminate against older travelers or those with pre-existing conditions by charging higher premiums or excluding certain medical issues from coverage.